This article is to provide some practical information on how one person should set up and manage their business accounts. Separating from individual accounts for transparency and legal purposes.

Any business owners, at one point, will have to decide on setting up bank accounts to facilitate the operation of their business. We will focus on steps to help you with setting up and managing business accounts in this article.

Previously, we have also shared with you two articles:

- Reasons for separating business and personal money, i.e., Managing money for individual vs. business (https://mo.com.mm/articles/managing-personal-and-business-finances/)

- Account management for personal accounts (https://mo.com.mm/articles/tips-to-set-up-and-manage-your-financial-accounts/)

After weighing the benefits and drawbacks of keeping personal and business funds separate, you must decide whether to create business accounts under your own name or the name of your company. Or whether you even require a business bank account for your company at all. It will depend on the business’s size and structure, legal framework, and license requirements.

Option 1: Account under the founder’s name

This may be an alternative if your company does not need an account in its name. In Myanmar, a “cottage” firm or small company with a small staff (3-5 workers) can open a bank account in the owner’s name without any difficulty. But, if you go with this option, you should still think about keeping your accounts separate – one for business use, the other for personal use. This will enable you to organize your finances transparently from the start. A robust and transparent financial and accounting system can come in handy if you ever decide to grow your business later and need to find outside investors for funding.

If you are the owner of the following businesses, go for this option:

- Self-trader

- Freelancer

- A single restaurant, shop, or online shop

- Your company does not deal with invoicing, and only pays a flat tax.

It makes life easier for you when it comes to filing your tax returns when you separate your personal income tax and business tax. It will be simpler to report your business expenses, such as marketing and business growth, under the business account as opposed to mixing them with personal expenses like paying rent, utilities, and other household expenses.

Another thing to bear in mind when using your personal account for business is the bank’s terms and conditions. Some providers explicitly state that using a personal bank account for business purposes is in breach of the terms of the account. Your account could be closed, or some features could be restricted if you are found to be using it for business.

Option 2: Account under the business name

You are required to open a bank account under the company’s name shown on the license when your company deals in higher quantities and contracts with your vendors and clients. If you operate a marketing agency or educational platform, for instance, other businesses may contract with you for services, and the payment may need to be paid to the business’s account.

Please be aware that there may be increased costs associated with opening a business account. You may choose to create both personal and business accounts with the same bank. One-stop shops or bundled services may be offered at preferential prices by some banks and fintech businesses. Please check the information in detail with your nearby banking partners.

If you are the owner of the following businesses, go for this option:

Cottage (below 9 employees) and Small (10-15 employees)

- Services companies like marketing, education, clinics….

- Non-profit organizations that engage in fundraising

- Import/export and E-commerce

- One store aiming to grow into multiple chains, franchise

- You have co-investors or co-founders in the business

Option 3: Hybrid between personal and business accounts

On one hand, you are not legally required to open a business account; on the other hand, it actually relies on what your business partners, clients, and suppliers expect in business contracts. For tax purposes, there is a difference between personal income tax and corporate tax from the transaction’s inflow and outflow from these two-account setups.

For example, if you run a store that sells food and beverages, you usually would open a bank account under his/her name. However, if a company wants to engage your shop for their special event where you are catering for all their staff, this company might require you to sign a contract with your company instead. They will settle payments only to the account under the business name and you will need to pay corporate tax on this income.

Another example is that your company is an education platform. Your company often signs contracts with your clients and suppliers for the coaching services you provide to their employees. Now if there is a special event, they want to engage only you (the owner) as a speaker in that event, they might request to sign the contract with you only. The settlement, at this time, will go to the bank account under your name. You need to pay personal income tax for this income.

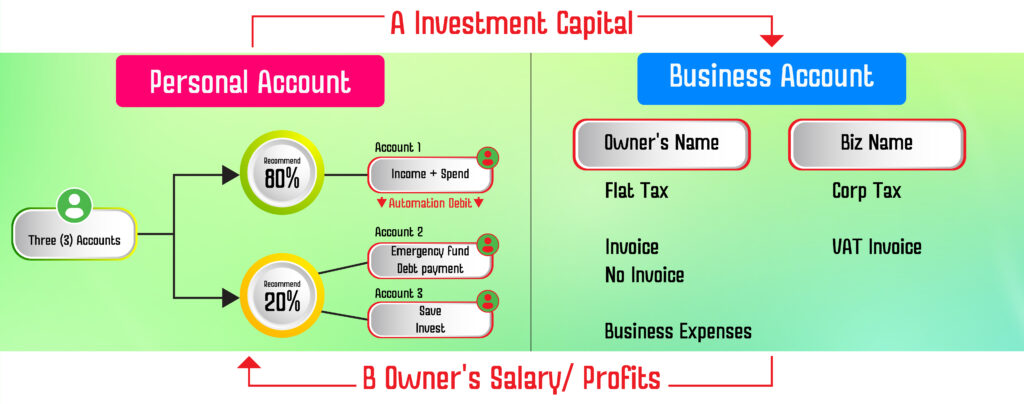

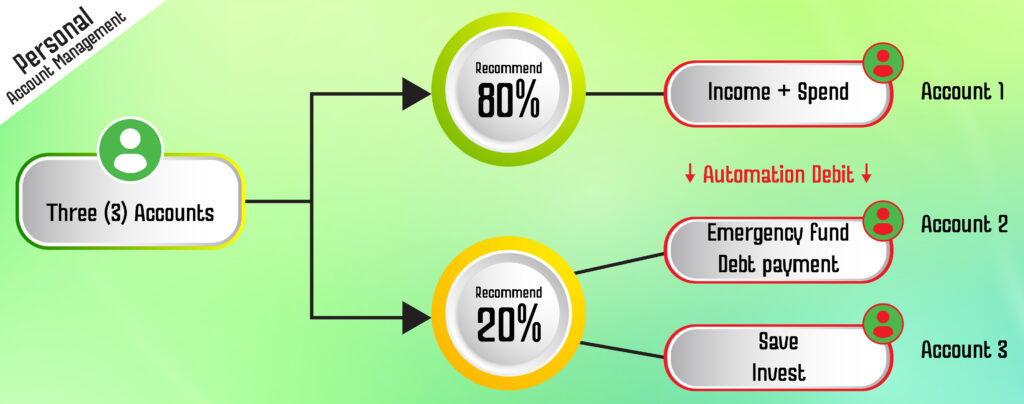

The below graphic is the comparison of both personal and business accounts:

A – You save up your personal money to invest in your company. Step A – you draw the funds from personal account no.3 and transfer them to Business account (as a registered capital).

B – If you draw a salary or profit from the business, this fund will transfer back to your personal account. As the owner, you have to decide if you want to withdraw a salary, or profits based on your financial goals. You also need to work with the accountant to understand the impact on the accounting book. For example, salary is a business expense and can be deducted from tax. And the salary can serve as your personal income and save towards big goals later like buying property for you and your family. Profit will incur business tax. And the profit from the business could be used to share between business owners and reinvest into expanding the business.