Starting a business is an exciting venture, but it also requires careful planning. You must have enough money saved up for the initial investment before you can even start to launch a small business. In fact, we have discussed three forms of financial planning you need for your small business in the previous article (https://mo.com.mm/articles/financial-planning-for-your-small-business/). They are 1. Startup costs, 2. Break-even point and 3. Cashflows

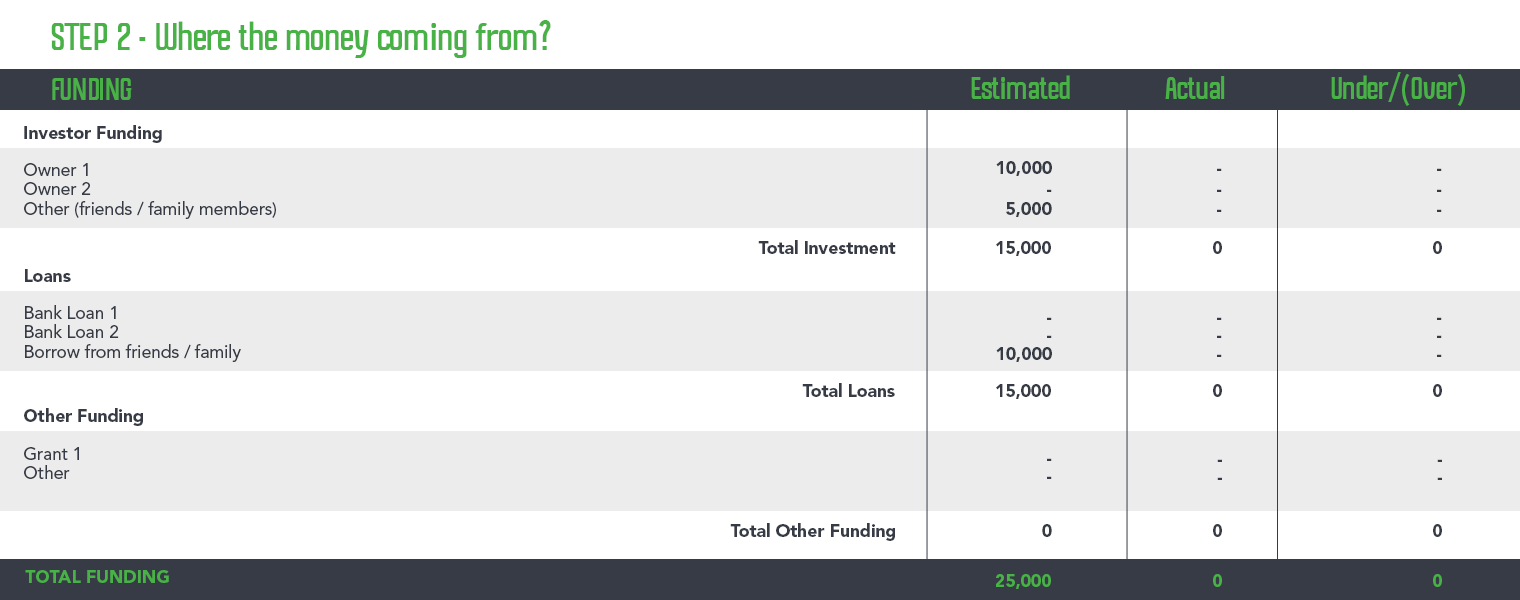

The “Startup Costs”, or initial investment capital, is the first important financial step. We have previously shown you the template you can jot down all expenses that make up the “Startup Cost”. You have determined that you need 20 million MMK to open your F&B store after going through this exercise, and the next step you need to know is where this money comes from. In fact, you will see the funding section on the “Startup Cost” template as captured below:

Potential Sources of Funding:

- Your own funds

- Loan

- Investment

- Community capital supports

Option 1: Your own money

Following the example that you need 20 million MMK for setting up the business, if you don’t have enough now, you can think about starting small and saving up while running your business. For instance, can you sell food online first, before renting a costly venue? It implies that your business must generate minimum revenue in its first few months in order to fund the operation and grow slowly, or you can think about taking on side jobs to save money and launching the business when you have enough. In this way, if the business falters, you can still rest assured that you have a backup job to fall back on.

If you have carefully planned your funds, you can save up to 20 million MMK in a shorter period with compound interest. It means that you do not just put the money in piggybank style, try to find a channel that can give you a decent annual return to help your money grow faster. We have explained or calculated how the money grows with compound interest in Account Management (https://mo.com.mm/articles/tips-to-set-up-and-manage-your-financial-accounts/)

Option 2: Loan

- Friends and Relatives: In the early phases of the businesses, owners can combine personal funds with loans from friends and relatives. This way you reduce the investment capital for yourself if you have not saved up enough. Before accepting any money from family or friends, it’s crucial to consider and talk about the idea of borrowing without interest versus a loan to prevent future conflicts. You really don’t want to lose a relationship over money matters. However, this no-strings-attached arrangement seems easy at the beginning, but your friends and family feel they have the right to participate in your business or ask you to return the money out of the blue.

- Credit institutions: The next best option for a start-up or small business is micro-loan through banks and other credit institutions. The two types of financing that banks offer to new businesses are term loans and working capital loans. These loans could be in the form of non-collateral or collateralized with your assets (property, car). However, please be careful of the high interest and penalization if you do not pay back in time. Almost all public and private sector banks provide loans for new businesses. The interest rate, loan size, and repayment period offered will differ from bank to bank. However, not all small businesses are credit-worthy to get a loan from banks. The processing and strict credit assessment could be a deal-stopper for many businesses to get to this source of funding. Some fintech or microfinance might serve lower credit customer profiles, therefore, involve certain risks.

Option 3: Investment or Equitization

Individuals with surplus cash are known to be Angel investors and they could be interested in investing in new start-ups in Myanmar. Another level up from individual investors is institutional levels like startup investment funds, venture capital, and accelerators. However, your small business might not pass the investment grade level unless your business has the scalability potential or disrupts the market by technology.

The risks involved in these investments by investors are more, as compared to loans offered by financial institutions. They only invest for higher returns to profit, therefore increasing pressures for business owners and they also get a share of your business in return. That kind of “strings attached” situation means that you are not in full control of your business.

The disadvantage of investment funding is it would take longer to find a suitable investor. Another disadvantage could be your company would need a robust reporting, audit, and financial system to assure transparency to the investor. This will require a significant amount of your time and resources, diverting you from your primary objective of growing the business.

Option 4. Community capital supports

In addition to capital support, startup businesses might need other resources (expertise, non-financial support). Some social platforms, associations, and foundations can be great places to incubate your business ideas. Capital is limited but knowledge is immense. Good leadership experience can maximize your initial investment and lead you to success. You may have good ideas but to bring business to success, there are many phases to bring your ideas to life (product build, marketing & sales, operations, human resources).

Conclusion

Before starting a business, it’s crucial to research prospective sources of funding and create a solid investment strategy. Making sure you have the required cash is essential, so looking into possibilities like angel investors, loans from banks or friends/family, and association support might be helpful.

It’s time to make a realistic budget with both short-term and long-term objectives after you’ve determined your desired source of funding and calculated how much cash you’ll need for launching your new business. This will assist in keeping your finances on track while enabling flexibility in case the market shifts or an unforeseen circumstance arises.